Calculate mark up and margin

This income statement provides all the information needed to calculate the net margin of Company XYZ. Mark up refers to the value that a player adds to the cost price of a product.

Markup Margin Table Sales And Marketing Profit The Final Frontier

The regulation was set up to reduce systemic risk from OTC derivatives.

. Californias Healthy Workplaces Healthy Families Act of 2014 requires employers to provide a set amount of paid sick leave PSL to employees working in California1. The markup calculator alternatively spelled as mark up calculator is a business tool most often used to calculate your sale priceJust enter the cost and markup and the price you should charge will be computed instantly. The mark-up added to the cost price usually equals retail price.

Initial Margin requirement is a component of the Unclear Margin Rules originated from the BCBS-IOSCO framework for OTC derivatives. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. By entering the wholesale cost and either the markup or gross margin percentage we calculate the required selling price and gross margin.

Although the Act establishes minimum requirements employers have the option to provide more time off than the minimum required under the ActWaiting time penalties go until full payment is made up to. Retail math is used daily in various ways by store owners managers retail buyers and other retail employees to evaluate inventory purchasing plans analyze sales figures add-on markup and apply markdown pricing to plan stock levels in the storeAlthough most accounting programs do the math for you as a business owner or accountant you should know. Mark up goods.

In reality the liquor cost can be lower and the profit margin higher for high-end bars and restaurants. We can represent contribution margin in percentage as well. As an example a markup of 40 for a product that costs 100 to produce would sell for 140.

If they decided that they wanted to produce 1800 units a month they. The retailer adds Rs 2 as his value and sells the soap to the. Transport tariffs may finally be up but the costs are increasing faster.

This KPI measures the ability of your company to pay off all its debts in. Under these circumstances prices typically go upmore people want it and more people are willing to pay for it. If you have a question about.

High fuel prices personnel costs insurance all steadily going up. However this must be done competitively otherwise the goods would be too expensive and fewer customers would purchase from the company. That means you will earn a profit of 250 on every pair of socks sold.

Calculate gross margin on a product cost and selling price including profit margin and mark up percentage. Lets use the same product to clarify the differences between markup and margin better. Mark-to-market MTM or M2M or fair value accounting is accounting for the fair value of an asset or liability based on the current market price or the price for similar assets and liabilities or based on another objectively assessed fair value.

Fill in the fields to calculate your cost per kilometer. Initial Margin implementation comes into effect in six phases with the last two going live on 1st of September 2021 and 1st of September 2022. With a markup percentage of 50 you should sell your socks at a 250 markup or a total price of 725.

Margin formula You can calculate profit margin as a percentage by dividing the profit margin in dollars by the sale price in dollars then multiplying by 100. Markup Percentage vs Gross Margin. For example if a company has the capability of producing up to 1000 units a month of a product given its current resources the relevant range would be 0 to 1000.

There are those that use the Price Multiplier Method. The typical liquor cost range for craft beer is between 20 and 26. 5 x 50 250 5 725 New Selling Price.

Enter your name and email in the form below and download the free template. For gross profit gross margin percentage and mark up percentage see the Margin Calculator. Net Profit Margin Net Profit Revenue.

Marking up goods selling goods at a higher price would result in a higher ratio. The value added is called the mark-up. In general however a margin of 40-50 is the standard.

Where Net Profit Revenue - Cost. Download the Free Template. Which means the craft beer profit margin is 74 to 80.

It can also be used to calculate the cost - in this case provide your revenue and markup. Percentiles are determined from the values in the body of the table not the z scores on the margin so look for the closest value to 090. Unit contribution margin per unit denotes the profit potential of a product or activity from the.

It gets more complex than that but well get into it later. 31 Explain Contribution Margin and Calculate Contribution Margin per Unit Contribution Margin Ratio. Profit percentage is similar to markup percentage when you calculate gross margin.

Theres nothing wrong with this but it can cause you to leave too much money on the table and it often results in a race to the bottom with your competitors. But when market demand decreases prices typically follow suit. There is no fast and easy way of determining the appropriate margin.

Given cost and selling price calculate profit margin gross profit and mark up percentage. When more people want a specific type of product this is an increase in market demand. For example a FMCG company sells a bar of soap to the retailer at Rs 10.

They have the status and ability to charge more for their beer. They simply multiply the total costs by 2 100 markup or 50 margin or by 3 200 markup or 67 margin in order to determine the mark-up they will put on their. Cost x 50 Margin Cost Selling Price Result.

Net Margin then please ask MarkAsk a question. The Markup is different from gross margin because markup uses the cost of production as the basis for determining the selling price while gross margin is simply the difference between total revenue and the cost of. This is the cost price.

Fair value accounting has been a part of Generally Accepted Accounting Principles GAAP in the United States since the early 1990s. Calculate Gross Profit Margin on Services. Searching the standard normal table for the 90th percentile.

This calculator can help you determine the selling price for your products to achieve a desired profit margin. If you were to follow the experts you would use the above Cost-based pricing formula to factor in all your costs then mark up that price by XX to arrive at your final selling price. When using this metric its a good idea to look at operational KPIs such as operating margin or operating profit to understand the data better.

This is the percentage of the cost that you get as profit on top of. While the total revenue is 100000 subtracting the COGS operating expenses interest and taxes results in a net profit of 30000. Profit mark up Rate This is the offer margin you add.

This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. Find out how to calculate transportation cost per kilometer.

Product Pricing Calculator Handmade Item Pricing Worksheet Etsy Business Template Pricing Calculator Product Pricing Worksheet

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Margin Markup Calculator And Converter Double Entry Bookkeeping Bookkeeping Double Entry Calculator

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infograph Financial Literacy Lessons Economics Lessons Finance Education

Distribution Channel Margin Calculator For A Startup Plan Projections Start Up Channel Business Planning

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

Markup Calculator Based On Cost Desired Profit Margin Http Www Calculatorsoup Com Calculators Financial Markup Calc Business Career Calculators Financial

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

Retail Markup Calculator Markup Pricing Formula Excel Margin Formula

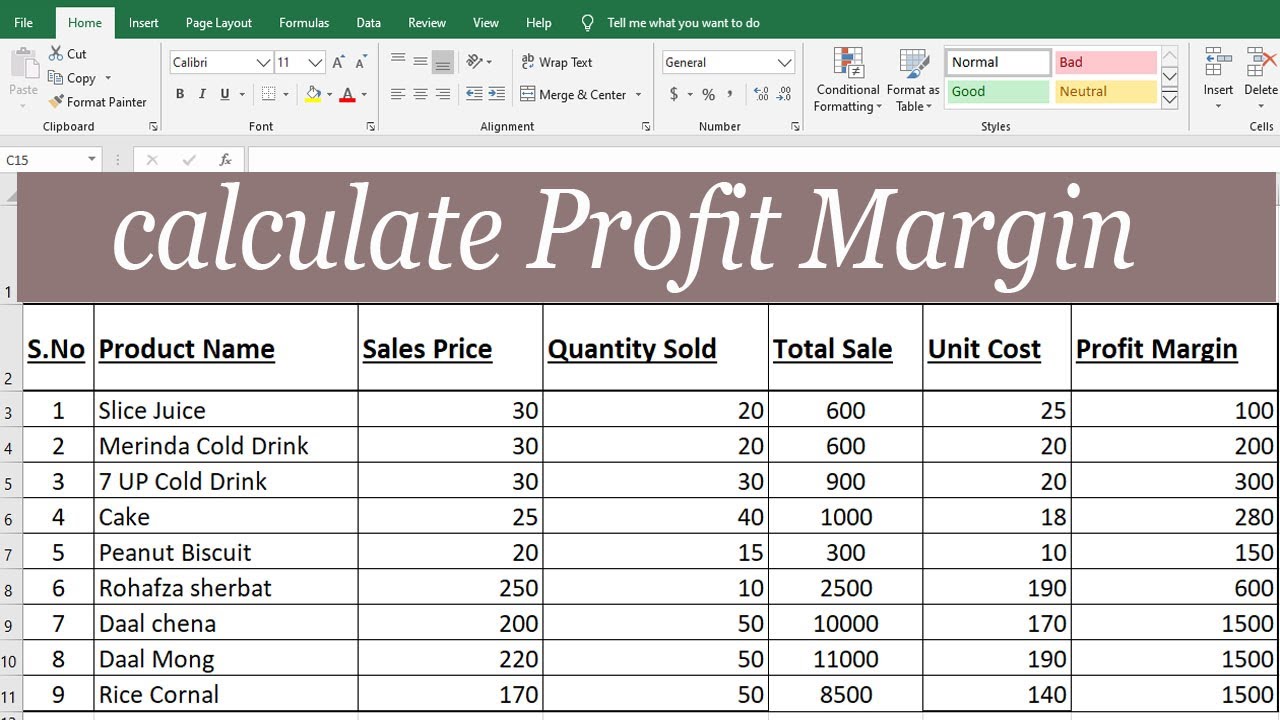

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Margin Vs Markup Calculator Excel Excel Excel Templates Calculator

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Markup Vs Margin Chart Infographic Calculating Margin Markup Chart Infographic Profit And Loss Statement Finance Investing

Retail Markup Calculator Markup Pricing Formula Excel Margin Formula

Markup Calculator Math Calculator Calculator How To Find Out

Find Out Your Estimated Etsy Seller Direct Checkout And Paypal Fees Etsy Seller Fees Etsy Business Etsy